Link PAN with Aadhar | PAN Card Link With Aadhar Card

Linking your PAN card with your Aadhar card is crucial for every Indian citizen.

Not only is it a government mandate, but it also ensures that your tax-related activities are seamless and without any hitches.

This detailed guide will walk you through the entire process of linking your PAN with Aadhar in simple and easy-to-understand terms.

Why Link PAN with Aadhar?

The Central Board of Direct Taxes (CBDT) has made it mandatory to link PAN (Permanent Account Number) with Aadhar to curb tax evasion. By linking these two crucial identification numbers, the government aims to ensure that every financial transaction is traceable and transparent. This move also helps in eliminating duplicate PAN cards issued under different names.

Real-Life Anecdote

Consider Mr. Sharma, a small business owner. He never linked his PAN with Aadhar, thinking it wasn’t necessary. When he applied for a loan, his application was rejected because his PAN was inactive. He had to go through a tedious process to reactivate his PAN, which delayed his business plans significantly. Linking PAN with Aadhar could have saved Mr. Sharma a lot of time and hassle.

Important Dates and Fees

- Start Date: 01 January 2023

- Last Date to Link PAN with Aadhar: 30 June 2023 (without penalty)

- Penalty Fee: Rs.1000/- (if linked after the deadline)

Fee Details

- Any Category: Rs.0/-

- Penalty Fee: Rs.1000/-

Documents Required for Linking PAN with Aadhar

You will need the following documents:

- Aadhar Card

- Driving License (DL)

- Voter Identity Card (Voter ID)

- Ration Card

- Arms License

- Passport

- Pension Card with Photograph

- Photo ID Card Issued By Any Central / State Government Authority

- Any Other Related Supported Document

Step-by-Step Guide to Link PAN with Aadhar

Linking your PAN with Aadhar is a straightforward process. Follow these steps:

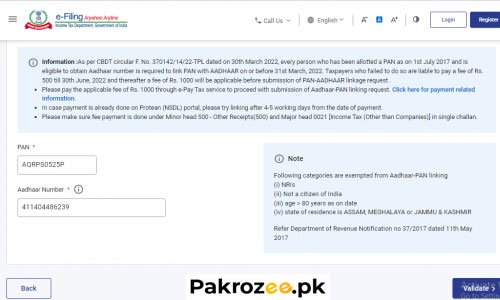

- Go to the e-filing portal and click on Link Aadhaar under Quick links.

- Enter your PAN and Aadhar numbers and click on Validate.

- Enter the mandatory details as required and click on Link Aadhaar.

- Enter the 6-digit OTP received on your registered mobile number and click on Validate.

- Check the status of your Aadhaar-PAN link request.

Online Tax Services

Several online platforms, such as SARKARIJOBFIND, offer tax services, including PAN Card and Aadhar linking. Using these services can simplify the process and ensure that all steps are correctly followed.

| Link PAN with Aadhar PAN Card Link With Aadhar Card | ||

| Important Dates | ||

| Start Date: 01 January 2023 Last Date to Link PAN with Aadhar (Without Penalty): 30 June 2023 Fee Details: Any Category: Rs. 0/- Penalty Fee (if linked after deadline): Rs. 1000/- | ||

| Documents Required for Linking PAN with Aadhar 2025 | ||

| Aadhar Card Passport Ration Card Arms License Driving License (DL) Voter Identity Card (Voter ID) Pension Card with Photograph Photo ID Card Issued By Any Central / State Government Authority Any Other Related Supported Document | ||

| IMPORTANT LINKS | ||

| PAN Link With Aadhar | Click Here | |

| Official Website | Click Here | |

| Check PAN Aadhar Link Status | Click Here | |

| PAN CARD Online Form 2023 FAQs | Click Here | |

How to Link Your PAN Card with Aadhaar Card

We have outlined a simple step-by-step guide to help you link your PAN card with your Aadhaar card. Follow the steps below to complete the process efficiently:

➡️Go to the e-filing portal home page and click on Link Aadhaar under Quick links.➡️ Link PAN with Aadhar.

➡️Enter the PAN and Aadhaar numbers and click on Validate.➡️ Link PAN Card with Aadhar Card

➡️Enter the mandatory details as required and click on Link Aadhaar.

➡️Enter the 6-digit OTP received on your mobile number mentioned in the previous step and click on Validate.

➡️Your request for linking Aadhaar has been submitted successfully. You can now check the Aadhaar-PAN link status.

Frequently Asked Questions (FAQs)

Q.1 Who needs to link Aadhaar and PAN?

- A: As per Section 139AA of the Income Tax Act, every individual with a PAN card as of 1st July 2017, and who is eligible to obtain an Aadhaar number, must link their Aadhaar with PAN.

Q.2 Can women also register for PAN CARD 2023?

- A: Yes, any adult, irrespective of gender, can register for a PAN card.

Q.3 What is the last date to link PAN with Aadhar without a penalty?

- A: The last date to link PAN with Aadhar without a penalty was 30 June 2023. Post this date, a penalty of Rs. 1000/- is applicable.

Q.4 How can I check my Aadhaar-PAN link status?

- A: You can check your status by visiting the official website and navigating to the ‘Link Aadhaar Status’ option.

Q.5 What happens if I don’t link my PAN with Aadhar?

- A: If you do not link your PAN with Aadhar, your PAN will become inoperative, and you will not be able to carry out any financial transactions requiring a PAN.

Link PAN with Aadhar Table

| Start Date | Last Date to Link (without penalty) | Penalty Fee (if linked after deadline) | Fee Details (Any Category) | Required Documents |

|---|---|---|---|---|

| 01 January 2023 | 30 June 2023 | Rs. 1000/- | Rs. 0/- | Aadhar Card, DL, Voter ID, Ration Card, Passport, etc. |

Conclusion

Linking your PAN card with Aadhar is a crucial step to ensure your financial transactions are smooth and hassle-free. By following the steps mentioned above, you can easily link your PAN with Aadhar.

Do it today to avoid any inconvenience and stay compliant with government regulations.